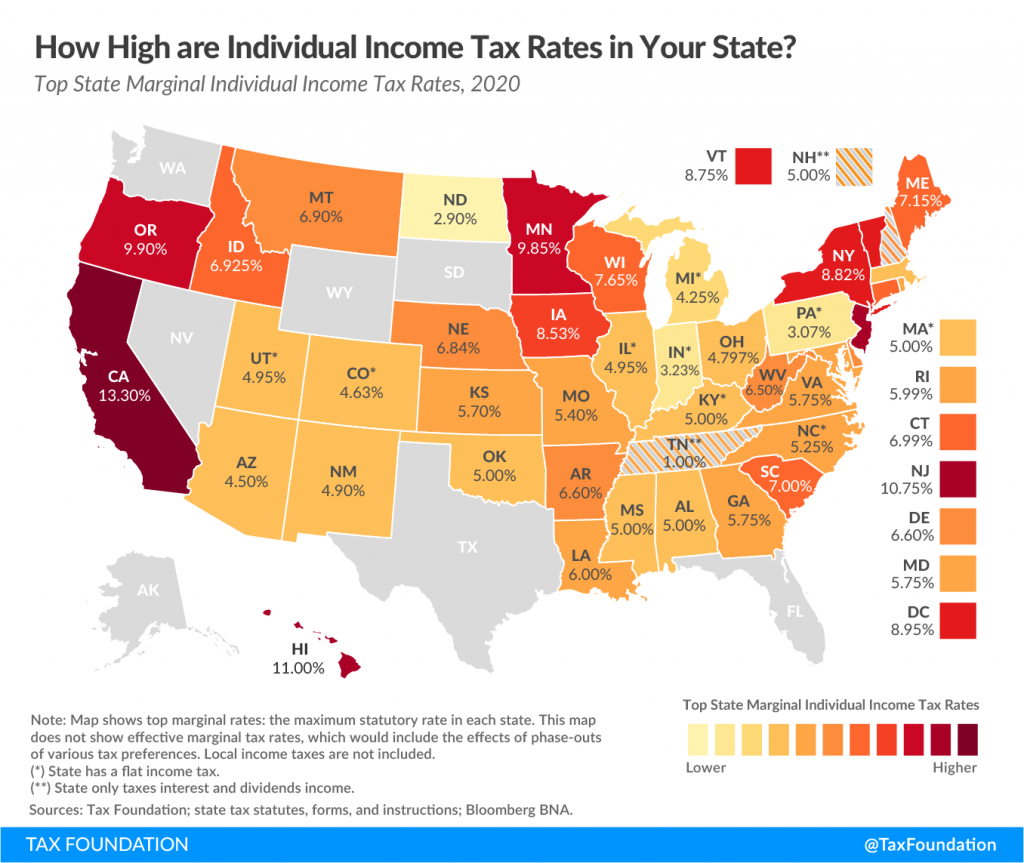

California Income Tax Rates 2025. 2025 california and federal income tax brackets. Income from $ 10,412.01 :

Detailed california state income tax rates and brackets are available on this page. When income taxes are due varies among the states that collect them.

how do i cancel my california estimated tax payments?, In keyword field, type tax table tax rate schedules. This page has the latest california brackets and tax rates, plus a california income tax calculator.

10+ 2025 California Tax Brackets References 2025 BGH, In keyword field, type tax table tax rate schedules. This page has the latest california brackets and tax rates, plus a california income tax calculator.

Mudarse para fora da Califórnia para escapar dos altos impostos após a, In keyword field, type tax table tax rate schedules. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, and 12.3%.

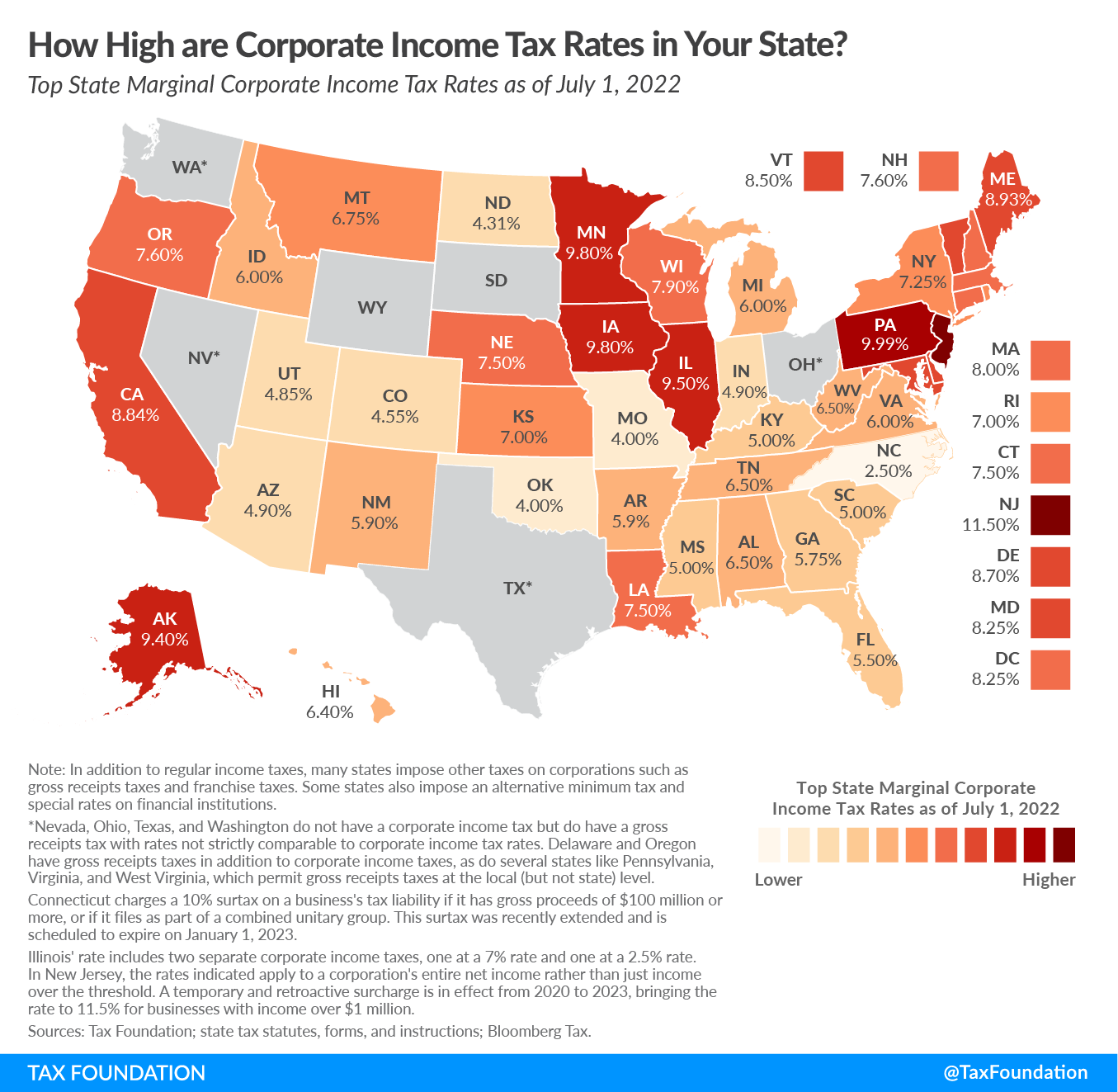

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, This is similar to the federal income tax system. Income from $ 10,412.01 :

Tax payment Which states have no tax Marca, 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, and 12.3%. 2025 income tax brackets by filing status:

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Up to $11,600 (was $11,000 for 2025) — 10% more than $11,600 (was. Knowing these dates will help ensure that you pay your taxes.

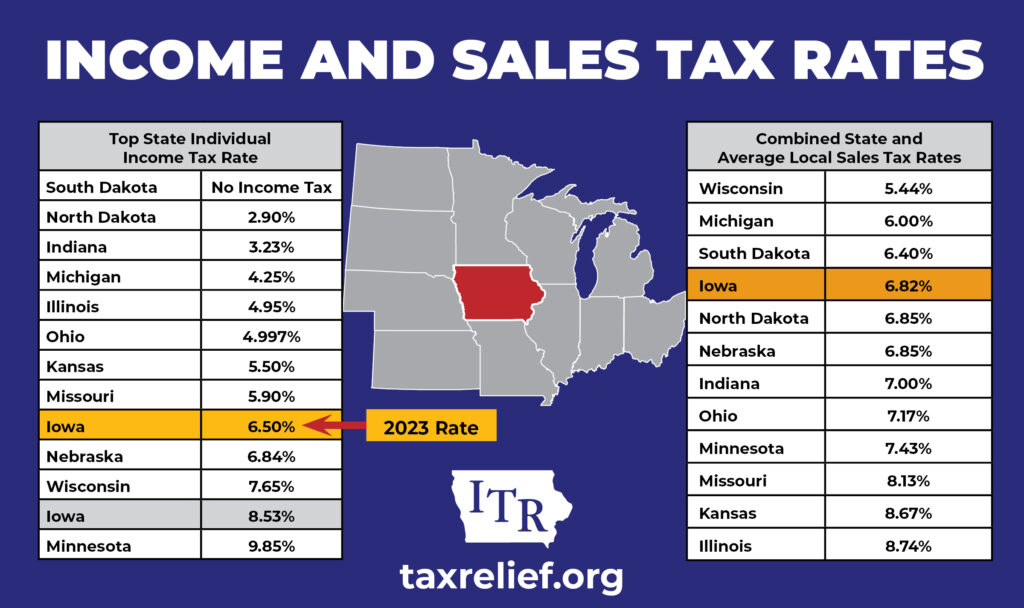

Midwest State and Sales Tax Rates Iowans for Tax Relief, The california income tax has ten tax brackets, with a maximum marginal income tax of 13.30% as of 2025. Income from $ 10,412.01 :

State Corporate Tax Rates and Key Findings What You Need to, Those who make over $1 million also pay an. Income tax | sales tax | property tax | corporate tax | excise taxes.

Tax brackets 2019 vptiklo, 2025 california and federal income tax brackets. File with a tax pro.

95,000 a Year Is How Much an Hour? Top Dollar, This page has the latest california brackets and tax rates, plus a california income tax calculator. This bill would revise the income tax brackets and income tax rates applicable under the personal income tax law (pitl) for taxable years beginning on or after.